👋 Hello!

As we wrap up CW4, this week's newsletter explores a significant shift in autonomous vehicle deployment strategy, highlighting how off-road applications are leading the way to commercialization.

Today's newsletter has 1,200 words and takes about 6 minutes to read.

🚗 Off-Road Autonomy: The Overlooked Path to AV Commercialization

While media headlines and public attention remain fixated on autonomous vehicles navigating city streets and highways, a quiet revolution is unfolding in the world of off-road autonomy. Away from the spotlight of urban testing grounds, companies are making remarkable progress in deploying autonomous solutions in controlled, industrial environments.

This week brought a significant milestone in this space: Kodiak Robotics has officially handed off two autonomous trucks to Atlas Energy Solutions, marking their first commercial launch. These trucks are already operational in West Texas's remote Permian Basin, where they've successfully completed 100 driverless deliveries of proppant (sand) in an off-road environment. What makes this particularly noteworthy is the business model: Atlas owns and operates the vehicles themselves, while Kodiak provides the autonomous technology and support.

"This is the first time, as far as we're aware, that the customer is owning and operating the driverless vehicle, instead of the AV company, and we think this is the model of the future," says Kodiak CEO Don Burnette. The company generates revenue through a combined hardware and software annual subscription model, which includes their modular sensors, self-driving software, monitoring, and update services.

To support this operation, Kodiak has established an 18,000-square-foot facility in Odessa with 12 employees, planning to grow to 20 as Atlas scales its driverless deployments throughout the year.

While the current support-to-vehicle ratio might seem high, it likely reflects initial deployment caution rather than the long-term operational model. As Atlas expands its autonomous fleet - though specific targets haven't been disclosed - this ratio should improve significantly for the business model to achieve its full economic potential. The core value proposition remains compelling: in remote locations where driver shortages are acute, autonomous vehicles can operate continuously, significantly increasing productivity and solving critical workforce challenges.

Kodiak's investment in a permanent facility and local team in West Texas also signals their confidence in the oil and natural gas industry as a key growth market for autonomous technology.

While off-road autonomy comes with its own unique challenges – including constantly changing landscapes and the inability to rely on HD maps – it offers distinct advantages. As Burnette notes, "Off-road autonomy has its own set of unique challenges, but it presents a faster path to revenue than highway driving." This faster path to commercialization is proving attractive to both technology providers and industrial customers.

Kodiak isn't alone in recognizing the potential of off-road autonomy. At CES 2025, industry giants showcased their progress in this space. Caterpillar, celebrating its 100th anniversary, demonstrated advanced autonomous mining equipment. John Deere, under their "Real Purpose, Real Autonomy" initiative, exhibited autonomous solutions across agricultural, construction, and landscaping applications. Komatsu presented innovations ranging from autonomous construction equipment to underwater dredging machines.

Perhaps the most compelling case for off-road autonomy can be found in the mining sector, where recent developments showcase both the scale and maturity of autonomous solutions. Just two weeks ago, EACON Mining announced a remarkable achievement: a fleet of over 800 autonomous haulage trucks that have collectively covered more than 27 million kilometers across 19 projects. This scale of deployment demonstrates that off-road autonomy isn't just a promising technology – it's already a proven solution delivering value in some of the world's most challenging environments.

The advantages of autonomous mining operations are multifaceted. First, these systems directly address the acute labor shortages in remote locations – a critical challenge for the industry. Second, they enable optimized workflow management, enhanced preventative maintenance, and remote control of multiple pieces of equipment from safe locations. Third, when combined with electrification efforts, autonomous systems can significantly reduce environmental impact while improving productivity.

We're seeing this play out globally. In China, the Yulong Copper Mine recently launched autonomous trucks operating at an altitude of 5,000 meters, achieving a 99% online operation rate and a 5% reduction in failure rates. EACON's success in deploying fully autonomous systems in as little as two weeks across diverse resources – from iron ore to copper-gold operations – demonstrates the technology's adaptability and scalability.

What's particularly noteworthy is the mining industry's holistic approach to modernization. The integration of autonomous technology is happening alongside other crucial transformations: the shift toward low-emission vehicles, the adoption of flexible fleet management systems, and an increasing focus on sustainability. This convergence of automation and electrification demonstrates how off-road autonomy isn't developing in isolation, but as part of a broader industrial evolution toward smarter, cleaner operations.

The bottom line? While the industry has long focused on autonomous vehicles for public roads, the real breakthrough in commercialization is happening in off-road applications. These deployments are proving the technology's reliability, building safety cases, and most importantly, generating revenue today rather than tomorrow. From Kodiak's autonomous trucks in the Permian Basin to EACON's extensive mining operations, off-road autonomy is showing us what the future of autonomous vehicle deployment might look like: practical, profitable, and already here.

🔗 China Daily / TechCrunch / FreightWaves / Forbes / PR Newswire

💡 Quick Takes:

🚗 Uber CEO: Human Drivers Here to Stay for Next Decade

Uber CEO Dara Khosrowshahi predicts a "hybrid network" will dominate for at least the next decade, with human drivers remaining predominant. While acknowledging that AV technology could be ready for "primetime" within two years, he emphasizes that commercialization faces bigger hurdles, particularly due to high hardware costs. Uber's strategy focuses on partnerships with AV developers like Waymo rather than developing its own technology.

🔗 Business Insider

💰 Inceptio Eyes US IPO

Inceptio Technology is planning a $100-200M US IPO, potentially joining fellow Chinese AV companies WeRide and Pony AI on Wall Street. The company's autonomous trucks have already logged over 200 million kilometers across China, serving major customers like SF Holding and Nestlé. However, the listing may face increased scrutiny under the incoming Trump administration, following recent SEC investigations into Chinese AV companies' data and mapping activities.

🔗 Bloomberg

🔬 Study Reveals Unexpected AV Safety Challenges for Young Drivers

New research from UM-Dearborn highlights concerning safety implications for young drivers of Level 3 autonomous vehicles. The study found that inexperienced drivers under 19 develop fatigue more quickly than middle-aged drivers when monitoring autonomous systems, leading to potentially dangerous "takeover" scenarios. These findings suggest the need for specialized fatigue monitoring systems, particularly as we approach an era where some drivers may only experience Level 3 vehicles.

🔗 University of Michigan

🚗 Italy Launches Urban AV Test

Italy has begun testing a self-driving Stellantis FIAT 500 in Brescia for car-sharing applications, marking a first-of-its-kind trial in Europe. The project, led by utility company A2A, includes autonomous charging capabilities and will run until November. While currently requiring a safety driver, project leaders are pushing for regulatory changes to enable truly driverless operations, highlighting Europe's ambition to compete with China and the US in autonomous mobility.

🔗 Reuters

📚 Worth Reading/Listening

Road Signs Podcast: What Will 2025 Bring for Autonomous Trucking?

Host Seth Clevenger sits down with Lori Heino-Royer, head of business development at Waabi, to explore the latest developments, breakthroughs and key industry partnerships.

🔗 Transport Topics

Torc Prepares for Commercial Operations

Peter Vaughan Schmidt, CEO, Torc joined Grayson Brulte on The Road to Autonomy podcast to discuss how Torc is preparing to launch commercial operations in Texas.

🔗 Road to Autonomy Podcast

German Transit Unions and Operators Outline Vision for 2035

The German Transport Association (VDV) and service workers' union ver.di have released their first-ever joint vision for public transit through 2035. The position paper emphasizes automation and AI integration while protecting worker interests, calling for increased federal funding and standardized regulations.

🔗 VDV

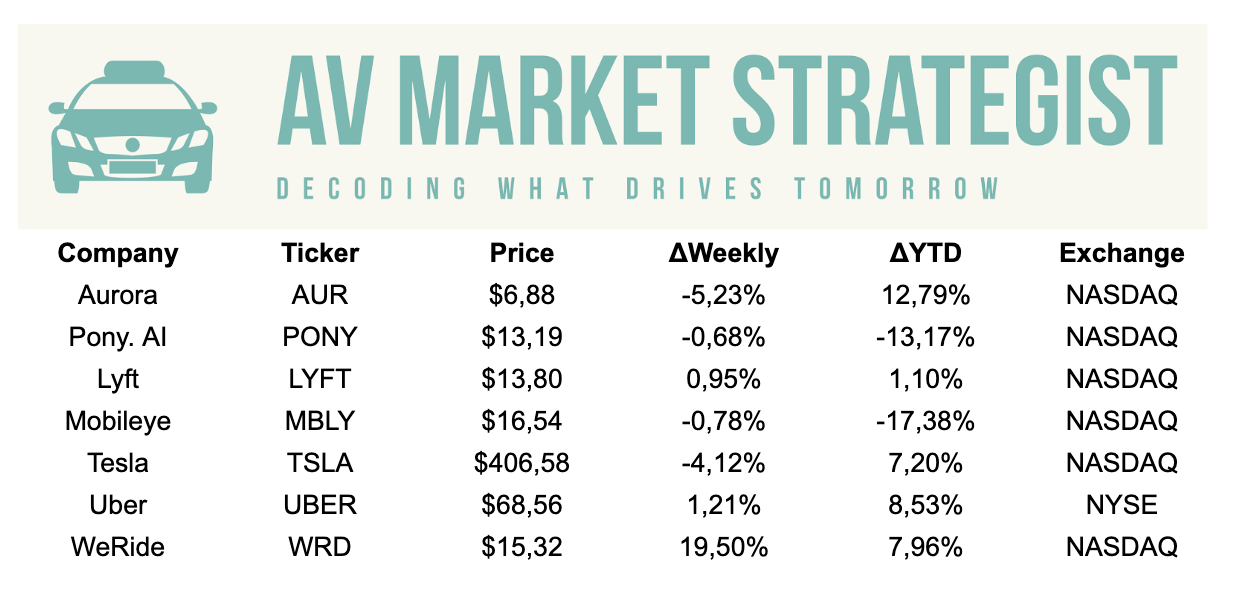

📊 Weekly Performance

Note: Stock performance data as of January 26, 2025. Past performance does not indicate future returns.

Thanks for reading!

If you found value in this newsletter, please consider sharing it with a friend or colleague who might benefit from these insights.

And if you haven't already, subscribe to stay updated on the latest developments in the autonomous driving industry.