👋 Hello!

As the fourth week of 2025 unfolds, we're witnessing significant shifts in the global autonomous vehicle landscape, marked by increasing US-China tensions and evolving market dynamics. China wants to position itself as the exporter of autonomy to the world and U.S. politicians do not want to see that happen. A battle is brewing globally over which country will ultimately control the future of autonomy.

Today's newsletter has 1,850 words and takes about 9 minutes to read.

🚗 US Ban on Chinese AVs Reshapes Global Autonomous Driving Landscape

The U.S. Department of Commerce's announcement of a sweeping ban on Chinese connected vehicles marks a decisive moment in the autonomous driving industry. The new restrictions, which will prohibit Chinese autonomous vehicle software by 2027 and hardware by 2029, are accelerating two key trends: the consolidation of the US market and the global expansion of Chinese players into alternative markets.

US Market: Consolidation Becomes Entrenched

The timing of this ban is particularly significant given the recent consolidation in the US autonomous vehicle market. With GM's shutdown of Cruise, the field has already narrowed significantly. Waymo now stands as the dominant player, providing 150,000 rides weekly across four major cities and covering over four million miles in 2024 alone. Their success in San Francisco, where they've matched Lyft's market share (within Waymo’s operating zone), demonstrates the potential of robotaxi services - but also highlights the limited competition in the market.

The ban effectively ensures this consolidated state will continue, as it prevents major Chinese players from entering the US market with their virtual driver technology. However, on the hardware side, the implications are more nuanced - particularly for market leader Waymo.

What might sound like a disaster at first - Waymo announced in 2021 that Chinese automaker Zeekr (owned by Geely) would build their next generation of robotaxis - could be manageable through careful structuring of the partnership.Despite the new regulations, Waymo remains confident this partnership won't be affected.

"We do not anticipate the final rule will impact our use of the Zeekr platform," Waymo spokesperson Ethan Teicher stated.

In fact, preproduction models are already being tested in San Francisco and Phoenix, with Zeekr planning to deliver the production version, called Zeekr RT, later this year.

The company's argument to the Commerce Department is straightforward: their vehicles shouldn't be subject to the new rules because all connected technology is American-owned and installed. The Zeekr vehicles arrive as "base vehicles," stripped of any telematics or communication systems, with Waymo's self-driving technology installed by authorized personnel after US delivery.

While the Commerce Department hasn't officially responded to questions about this partnership, Waymo continues to expand its operations. Currently operating modified Jaguar I-Pace vehicles in Phoenix, San Francisco, and Los Angeles, the company aims to add Atlanta and Austin to its network this year, supplemented by their new deal to deploy Hyundai Ioniq 5 vehicles.

The Zeekr RT could play a crucial role in this expansion by potentially reducing vehicle costs compared to the premium-priced Jaguar I-Pace. However, even if the ban doesn't affect Waymo's partnership with Zeekr, questions remain about the impact of new 100% tariffs on Chinese EVs. How this situation unfolds will be crucial for Waymo's scaling strategy.

The remaining US players show limited momentum: Amazon's Zoox maintains a conservative deployment approach, while Motional faces uncertainty despite Hyundai's $475 million investment following Aptiv's withdrawal.

Chinese Players: Accelerated Global Expansion

Faced with US market restrictions, Chinese autonomous vehicle companies are aggressively pursuing opportunities in other regions. Recent developments highlight this strategic pivot:

WeRide, fresh from its NASDAQ listing, has just announced a pilot project in Switzerland. Partnering with Swiss Federal Railways (SBB) and the Canton of Zurich, they'll deploy fully autonomous vehicles in the Furttal Region starting mid-2025, with plans to expand to twelve vehicles by 2026. This marks WeRide's third European project in just eight months, following successful launches at Zurich Airport and the 2024 French Open.

Meanwhile, Pony.ai is strengthening its position in its home market through significant regulatory breakthroughs and ambitious expansion plans. The company just became one of the first to receive permission for "driver out" testing on Beijing's expressways and highways. This milestone allows their autonomous vehicles to operate without a driver behind the wheel (though with a safety operator in the passenger seat) on nearly 90 kilometers of high-speed roads, connecting Yizhuang District to key transportation hubs like Beijing Daxing International Airport and Beijing South Railway Station. The extended operating hours - from 7:00 am to 1:00 am for airport routes - demonstrate increasing regulatory confidence in autonomous technology on high-speed roads.

Beyond testing, Pony.ai is pursuing aggressive commercial expansion. The company plans to quintuple its robotaxi fleet from current 200+ vehicles to about 1,000 this year - a scale they believe will enable operational break-even. Their growth trajectory is even more ambitious long-term, targeting 2,000-3,000 vehicles by end of 2026 and over 10,000 in the next three to five years. This expansion is supported by strategic partnerships with major automakers including Toyota, BAIC, and GAC Aion for their seventh-generation robotaxi vehicles. The company is also pursuing international growth, with imminent road tests planned in South Korea, a new R&D center in Luxembourg, and planned operations in Europe and the Middle East.

Baidu's Apollo Go continues to demonstrate the scale possible in the Chinese market, operating in 11 cities with 28 million driverless miles and 8 million rides completed. Their cost leadership position is particularly noteworthy - offering 6.2-mile rides for as little as $0.60 to $2.30, compared to $2.47 to $4.11 for traditional taxis. This aggressive pricing is enabled by their sixth-generation robotaxi, the RT6, which costs less than $30,000 per unit in production due to its modular design. Such cost advantages could prove crucial as Chinese companies expand internationally, potentially allowing them to undercut existing transportation services in new markets.

Looking Ahead: Market Outlook

As we look to the rest of 2025, I expect to see continued aggressive expansion from Chinese autonomous driving companies into markets outside the US. Their ability to leverage economies of scale and offer more affordable robotaxi services makes them formidable competitors in new markets. Their focus will likely remain on Europe and the Middle East, where we're already seeing significant momentum.

The Middle East, with its tech-friendly regulatory environment and openness to innovation, presents an attractive expansion opportunity. Europe, while potentially more challenging due to strict privacy regulations, remains a crucial strategic market. Chinese players are smartly using pilot projects - like WeRide's Swiss initiative - to demonstrate regulatory compliance and build trust with local authorities and consumers.

In the US market, Waymo's dominance looks set to continue, while Amazon's Zoox might finally accelerate its deployment. It will be particularly interesting to watch Waymo's international expansion plans - their announced entry into Japan in 2025 might just be the first step in a broader global strategy.

As autonomous driving technology matures and deployment accelerates, 2025 is shaping up to be a pivotal year for the industry. The success of Chinese companies in establishing themselves in new markets, while navigating complex regulatory requirements, could reshape the global autonomous vehicle landscape. Meanwhile, the response from established players like Waymo to this international competition will be crucial in determining how the market evolves.

🔗 TechCrunch / China Daily / Forbes / WeRide / CNEVPost / SCMP / WIRED

💡 Quick Takes:

⚖️ Waymo Wins Legal Battle in San Francisco

A California appeals court has unanimously rejected San Francisco's challenge to Waymo's operating permit, reinforcing the company's position in its most important market. The city's concerns about public safety were dismissed, with the court noting that incidents involving Waymo's vehicles were "relatively minor" with no injuries. Notably, the City Attorney's office acknowledged Waymo as a "good actor" - a significant distinction from Cruise, whose permit was revoked following safety incidents. The decision effectively normalizes AV operations in San Francisco, despite ongoing concerns from local officials and labor unions.

🔗 SF Examiner

🔄 MAN Trucks Opens Autonomous Driving Dataset

MAN Truck & Bus has released the world's first freely available sensor and driving data for autonomous trucks, marking a step toward open collaboration in commercial vehicle automation. This could accelerate development timelines and improve safety standards across the industry.

🔗 MAN

📱 Sunderland Taps Oxa for Autonomous Shuttle Project

The Sunderland Advanced Mobility Shuttle (SAMS) project has selected Oxa to provide autonomous technology for its Ford E-Transit shuttle program launching in Q1 2025. The initiative aims to demonstrate how autonomous shuttles can improve urban connectivity while reducing environmental impact. This project, part of Sunderland's smart city initiative, will collect passenger feedback to assess the real-world effectiveness of autonomous public transport in urban environments.

🔗 Traffic Technology Today / LinkedIn Analysis

🚘 Masdar City Advances Autonomous Infrastructure

UAE's Masdar City unveiled new autonomous vehicle infrastructure, positioning itself as a key testing ground for AV technology. This development aligns with the broader trend of Middle Eastern markets becoming important proving grounds for autonomous technology.

🔗 WAM

🛡️ Marine Corps Awards First Off-Road Autonomy Production Contract

In a milestone for military autonomous vehicles, the Marine Corps has contracted Oshkosh Defense to integrate Forterra's autonomy package into their ROGUE Fires unmanned missile launcher. This marks the Pentagon's first production contract for off-road autonomous driving capability, moving beyond traditional Leader-Follower technology. The $40 million project demonstrates growing military interest in autonomous capabilities for challenging environments, though Army officials note the continuing challenges of developing reliable off-road autonomy algorithms.

🔗 Defense News

📚 Worth Reading

Make Better Strategic Decisions Around Slow-Developing Technology

This timely analysis provides crucial frameworks for evaluating long-term technological investments, particularly relevant for autonomous vehicle strategy. The article offers valuable insights for companies navigating the extended development cycles characteristic of AV technology.

🔗 Harvard Business Review

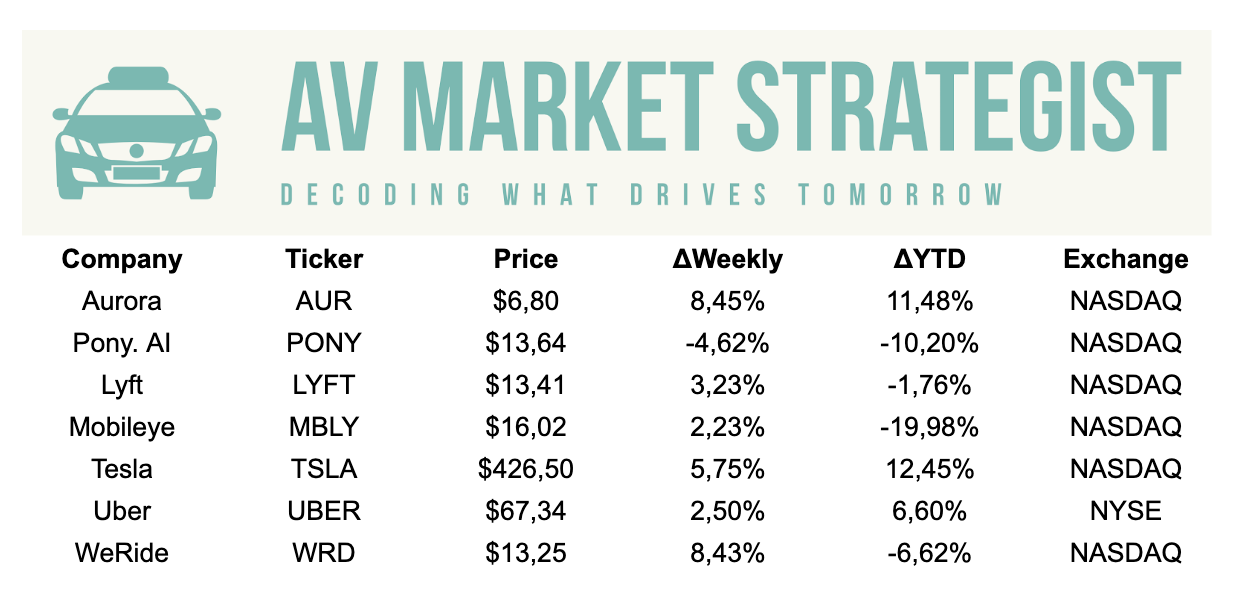

📊 Weekly Performance

Note: Stock performance data as of January 19, 2025. Past performance does not indicate future returns.

Thanks for reading!

If you found value in this newsletter, please consider sharing it with a friend or colleague who might benefit from these insights.

And if you haven't already, subscribe to stay updated on the latest developments in the autonomous driving industry.