AV Market Update CW14

Robotaxi economics: 70% cost reduction revealed, Pony's 7th-gen robotaxis achieve breakthrough

👋 Hello!

this week's edition takes a deep dive into Pony.ai's first earnings release and earnings call since going public, examines Waymo's strategic expansion announcement, and rounds up several other significant industry developments that emerged this week.

With autonomous mobility approaching a commercial inflection point, these updates provide valuable insights into how different players are positioning themselves for the next phase of market growth.

Today's newsletter has 2,950 words and takes about 12 minutes to read.

🔍 How Pony.ai Makes It’s Money

Pony.ai's first earnings as a public company offers a glimpse into a transformative moment for the autonomous vehicle industry. The company's financial results and strategic positioning suggest that after years of technological development and regulatory groundwork, the AV sector is finally approaching the mass commercialization phase that has long been promised but remained elusive.

"We consider this an exciting time for Pony.ai as we report our first earnings results as a public company," CEO James Peng told investors on the earnings call. "Our Nasdaq listing marks a significant milestone and is timed perfectly with the imminent mass commercialization of our robotaxi services."

A closer look at the financials reveals the complexities of a company in transition from R&D to commercialization.

Revenue reached $75 million for FY2024, representing a modest 4.3% year-over-year growth. However, this overall figure masks significant segment-level dynamics. Robotruck services delivered $40.4 million (up 61.3% YoY), while robotaxi services generated $7.3 million (down 5.3% YoY), and licensing/applications brought in $27.4 million (down 30.1% YoY).

When asked during the Q&A session about the quarterly revenue decline in Q4 compared to the overall annual growth, CFO Leo Wang explained:

"If you look at our current revenue, it consists of recurring revenue such as robotaxi fair charging service to the public and robotruck logistics service to our business partners. We also have project-based revenue... Given we have a portion of revenue that is tied to milestone-based projects, that revenue will be recognized upon delivery of contractual obligations. Revenue recognition naturally would fluctuate across different quarters."

The cost side of the equation showed substantial investments, with total operating expenses increasing 85.4% to $296.9 million. However, excluding share-based compensation, non-GAAP operating expenses grew at a more modest 8.7% to $169.9 million.

An Analyst directly questioned these increases during the call: "Would you mind giving some colors on why your 2024 costs and expenses were higher year-over-year and also any guidance on costs going forward?"

Wang explained that the elevated expenses were strategically targeted:

"Since the second half of 2024, we have been working on three vehicle models of our seventh-generation autonomous driving system. This incurred the corresponding R&D expenses growth. We consider this ongoing development very critical to implement our robotaxi first, China first, and tier-one city first strategy."

Despite widening losses—net loss expanded to $275 million from $125.3 million in 2023—the company maintains a strong balance sheet with $825.1 million in cash and investments as of December 31, 2024.

Wang emphasized that while they expect continued fluctuations in quarterly results, the long-term focus remains on developing and deploying their seventh-generation system:

"We will continue and even accelerate our seventh-generation system development as our top priority and deploy these vehicles in Tier-1 cities from hundreds to thousands."

Beyond the numbers, the most consequential insight lies in the technological and operational developments powering Pony.ai's commercial roadmap. The company's seventh-generation autonomous driving system has reduced unit BOM costs by over 70% compared to previous iterations – a transformative achievement that directly addresses one of the fundamental barriers to commercial viability.

"Along with continued improvements in operational efficiency, we're now on the right track to achieve breakeven at the individual vehicle level," Peng explained during the Q&A session. "In other words, we will have a positive contribution margin from the seventh-generation robotaxis."

This cost reduction, combined with significantly improved safety performance, has produced tangible economic benefits.

CTO Tiancheng Lou noted that "Our safety record enabled our commercial insurance cost per robotaxi to be reduced to almost half that of traditional taxis."

This represents an objective, third-party validation of the technology's maturity, as insurance providers are assessing the risk profile of autonomous vehicles as lower than human-driven alternatives.

The strategic foundation for Pony.ai's commercialization approach is what they call: “Robotaxi-first, China-first, and tier-one cities first”.

When asked about this approach during the earnings call, Peng offered a detailed rationale: "China has the largest ride-hailing market with around 40% of the global market measured by the number of orders. This is roughly twice the size of the U.S. market. Within China itself, Tier-1 cities represents the largest share backed by supportive regulatory environment and growing user demand."

This China-centric strategy stands in stark contrast to competitors like WeRide, which is pursuing aggressive international expansion. WeRide recently became the first autonomous driving company to secure L4 driverless permits across five countries (China, UAE, Singapore, France, and the U.S.), demonstrating a fundamentally different approach to market development.

Similarly, Baidu's Apollo Go is making significant international moves with new partnerships in Dubai and Abu Dhabi, planning to deploy up to 1,000 autonomous vehicles in these markets by 2028.

Interestingly, while Pony.ai emphasizes its "robotaxi-first" strategy, a closer look at its revenue breakdown reveals that robotruck services currently generate substantially more revenue - $40.4 million in 2024 compared to just $7.3 million from robotaxi services.

This 5.5x difference suggests that despite the strategic focus on robotaxis, the immediate commercial traction is stronger in logistics applications. In his presentation of financial results, CFO Leo Wang did not directly address this discrepancy, but instead emphasized the growth potential in the robotaxi segment:

"Our robotaxi services revenue also included passenger fares, which saw a significant year-over-year increase driven by the expansion of our public-facing fare-charging robotaxi operations in Tier-1 cities. We expect this part of growth will continue and even accelerate as we deploy the seventh-generation autonomous driving vehicles."

Following the “Robotaxi-first, China-first, and tier-one cities first” strategy, just days after its earnings report, Pony.ai secured the first-ever permit to operate paid fully driverless robotaxis in Shenzhen's Nanshan District, a vibrant economic hub with a GDP approaching ¥1 trillion.

This expansion creates Shenzhen's first cross-district driverless network, connecting Nanshan with Baoan District (home to 4 million residents and the international airport). With this addition, Pony.ai has now achieved commercial operational presence across all of China's Tier-1 cities.

The capabilities to scale commercially rest on Pony.ai's fundamental technological approach. Pony.ai employs reinforcement learning through their "PonyWorld" simulation environment:

"Our virtual driver teaches itself through billions or even trillions of generative acts of trials. This allows our virtual driver to understand why by analyzing the outcomes of every action, equipping them to make smarter decisions in complicated scenarios."

This approach has yielded a 16x improvement in safety performance while enhancing comfort and efficiency.

The translation of technological advantage into commercial viability has been further accelerated by strategic partnerships with major automakers.

"Our deep collaboration with OEMs is one of the keys to ensuring our robotaxi commercialization at scale," Peng explained.

The company's agreements with Toyota, BAIC, and GAC Group go beyond manufacturing. For example, "The joint venture we established with Toyota last year is actually a more comprehensive partnership. It will provide capital for vehicles, operate as a fleet company to burden the CapEx, and also utilize the existing Toyota dealer network for vehicle maintenance."

Looking ahead, the autonomous vehicle industry's trajectory will largely depend on whether companies like Pony.ai can deliver on all four pillars that CEO James Peng has consistently emphasized: technology, regulation, mass production, and large-scale operation.

While the company claims significant progress across all four, each will face distinct challenges in 2025 and beyond.

On the technology front, Pony.ai's shift from imitation learning to reinforcement learning appears promising, with their PonyWorld simulation environment delivering a claimed 16x safety improvement. However, this technological approach will need to prove itself at much larger fleet scales. The reduced insurance costs—already at 50% of traditional taxis—provide an early economic validation of these safety claims, but the real test comes with widespread public usage.

The regulatory pillar currently represents Pony.ai's strongest advantage. Their fully driverless commercial permits across all of China's Tier-1 cities create a strong market positioning. The Shenzhen permit completes this strategic positioning.

Mass production capabilities remain the most critical near-term challenge. The 70% cost reduction in the seventh-generation system is essential for unit economics. The planned production ramp in the second half of 2025 will be a crucial indicator of whether this pillar can support the company's ambitions.

Finally, large-scale operations will determine whether the business model can achieve profitability. Currently averaging 15 daily orders per vehicle, Pony.ai must significantly increase utilization rates while controlling operational costs.

When asked directly about challenges to mass commercialization, Peng offered an unusually confident assessment: "We do not foresee any insurmountable challenges that prevent us from achieving mass commercialization." This statement will be tested against the realities of scaling complex operational businesses in dense urban environments.

The AV industry has repeatedly underestimated the complexity of transitioning from technological capability to commercial sustainability. Pony.ai's $825 million cash position provides runway, but the company will need to demonstrate clear progress on all four pillars to maintain investor confidence.

🔗 Pony.ai (1) / Pony.ai (2) / Gasgoo (1) / Gasgoo (2)

🚗 Waymo Accelerates US Expansion Strategy

Waymo announced this week plans to launch its robotaxi service in Washington, D.C. in 2026, adding to its growing nationwide footprint. This comes as the company continues to dominate the U.S. autonomous vehicle landscape, with operations already established in Phoenix, Los Angeles, San Francisco, Austin, and parts of Silicon Valley, plus Atlanta and Miami set to launch .

The timing of this announcement is particularly intriguing given the current regulatory landscape. The incoming Trump administration has signaled plans to develop federal standards for testing and operating self-driving vehicles, while Tesla CEO Elon Musk – who will serve as a key White House adviser – has advocated for national standards that would supersede the current patchwork of state regulations.

However, a critical detail makes this announcement particularly noteworthy: Washington D.C. currently doesn't permit fully driverless operations. The District's current permits still require a human driver behind the wheel, which fundamentally conflicts with Waymo's business model that depends on removing human drivers from vehicles.

This raises the obvious question: Why would Waymo, with its carefully cultivated reputation as "the world's most trusted driver," announce a service a year in advance that it doesn't know for certain it can deliver due to regulatory constraints?

For a company with Waymo's market position and credibility, making promises it can't keep would risk damaging its brand.

The most logical explanation is that Waymo knows something we don't. The company has no pressing business need to make this announcement

They're already the undisputed leader in commercial robotaxi operations with over 200,000 fully autonomous paid trips weekly, far outpacing any competitor. This suggests higher confidence in regulatory developments than is publicly known.

From a strategic perspective, bringing robotaxis to Washington D.C. represents a masterstroke of influence. The real value isn't in the market size of the nation's capital, but in who will be riding in those vehicles.

By 2026, Waymo wants U.S. lawmakers, regulators, and global diplomats to experience autonomy firsthand, creating powerful advocates who can shape policy based on direct experience rather than theoretical concerns.

Interestingly, Waymo's expansion ambitions may extend beyond U.S. borders:

Source: X

Following a visit from UK officials to San Francisco where they experienced a Waymo ride, the company posted on social media: "Thanks for riding UKinUSA & peterkyle – we can't wait to one day bring the magic of Waymo One to the UK!"

This casual statement has sparked speculation about potential UK expansion, suggesting Waymo is carefully considering selective international moves beyond its dominant home market position

Bottom line:

Waymo continues to dominate the autonomous vehicle news landscape. There's rarely a week without significant Waymo developments, and they're methodically extending their lead through strategic market selection, operational excellence, and what appears to be sophisticated regulatory positioning.

While competitors announce intentions or secure individual permits, Waymo is already operating at commercial scale and preparing for the next phase of industry development where regulatory frameworks, not just technological capabilities, will determine market leaders.

🔗 Waymo / Bloomberg / TechCrunch / LinkedIN

💡 Quick Takes:

🌍 WeRide Becomes First Company to Hold L4 Driverless Permits Across Five Countries

WeRide has secured France's Level-4 driverless public road testing and operating permit, making it the first and only technology company worldwide to hold driverless permits across five countries: China, UAE, Singapore, France, and the U.S. The company completed the rigorous approval process in just three months—setting a record for France's fastest driverless permit approval. WeRide's autonomous minibus is now authorized to operate at speeds up to 40 km/h, marking the highest-speed driverless permit issued in France.

🔗 WeRide / LinkedIN

🇯🇵 TIER IV Secures Level 4 Certification for Autonomous Bus Service in Japan

TIER IV has received Level 4 certification for an autonomous bus service in Komatsu, Japan. The certification applies to the entire route from Komatsu Station to Komatsu Airport and a designated section of the return route. Since launching in March 2024, the service has transported over 18,000 passengers, demonstrating growing demand for autonomous public transit solutions in Japan.

🔗 Tier IV

🚚 Aurora Innovation to Expand All-Weather Autonomous Truck Operations

Aurora Innovation plans to allow its self-driving trucks to operate without a driver in inclement weather ahead of launching commercial trips in Texas this year. The autonomous trucks are expected to start operating on public roads in Texas, New Mexico, and Arizona in 2025, with speed capabilities ranging from 25 mph to 75 mph. The company is enhancing its operational design domain (ODD) to include harsh weather conditions, suburban and urban areas, dense traffic, and highway construction zones.

🔗 Reuters

🤝 Daimler Truck and ARX Robotics Plan Strategic Partnership for Autonomous Military Vehicles

Daimler Truck and ARX Robotics have signed a memorandum of understanding to jointly develop the next generation of digital military vehicles. The partnership aims to integrate ARX Robotics' AI and robotics technologies into Daimler's Unimog and Zetros military vehicle platforms, enhancing connectivity, operability, and efficiency. The collaboration will focus on teleoperation and autonomous off-road driving capabilities, powered by ARX Robotics' innovative Mithra OS operating system.

🔗 Daimler Truck

🌆 Baidu's Apollo Go Expands Internationally with Dubai and Abu Dhabi Partnerships

Baidu's autonomous ride-hailing platform, Apollo Go, is making a significant international push with two new Middle East partnerships. In Dubai, Apollo Go has signed an agreement with the Roads and Transport Authority to deploy 100 fully autonomous vehicles by the end of 2025, scaling to 1,000 by 2028. Separately, Apollo Go partnered with UAE-based Autogo to deploy what aims to be the largest fully driverless fleet in Abu Dhabi. These moves mark Apollo Go's first international fleet deployment outside mainland China and Hong Kong, leveraging its experience of over 150 million kilometers of safe autonomous driving and 10 million cumulative rides.

🔗 PR Newswire (1) / PR Newswire (2) / LinkedIN

📚 Worth Reading

VDV Position Paper: "Der ÖPNV der Zukunft fährt autonom" (German)

Their vision positions public transit as the innovation driver for autonomous driving in Germany, with potential benefits for employment, technological leadership, market development, digitalization, public services, and climate protection.

🔗 VDV

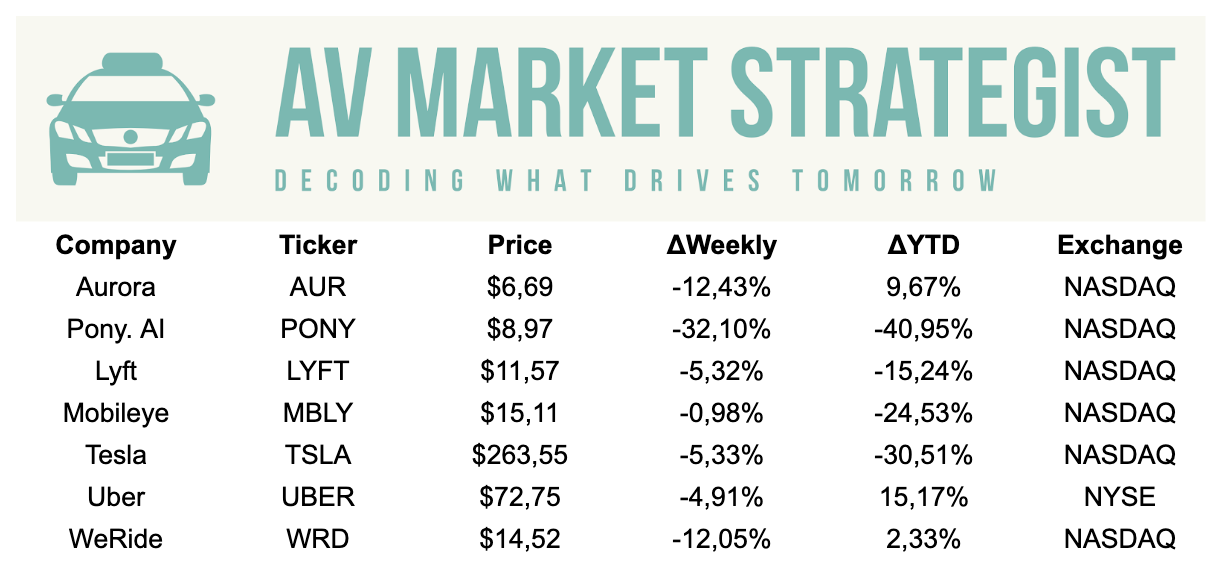

📊 Weekly Performance

Note: Stock performance data as of March 30, 2025. Past performance does not indicate future returns.

Thanks for reading!

If you found value in this newsletter, please consider sharing it with a friend or colleague who might benefit from these insights.

And if you haven't already, subscribe to stay updated on the latest developments in the autonomous driving industry.