$47B robotaxi opportunity in China alone -who's winning?

3 earnings reports reveal growth: Pony.ai, WeRide, Baidu

👋 Hello!

Pony.ai, WeRide, and Baidu earnings are out.

We're diving into their Q1 results, market developments, and Goldman Sachs' latest forecasts for China's robotaxi market.

Let's jump in.

Today's newsletter has 2,168 words and takes about 10 minutes to read.

🚗 China's Robotaxi Earnings Season

Earnings season just delivered a masterclass in how China's autonomous vehicle market is evolving from experimental technology to commercial reality. As Pony.ai, WeRide, and Baidu reported their latest results, a fascinating picture emerged: three companies competing for dominance in what Goldman Sachs projects will become a $47 billion market by 2035.

Goldman Sachs forecasts China's robotaxi market will explode from just $54 million in 2025 to $47 billion by 2035—a staggering 870x growth trajectory. By 2030, they expect 474,000 robotaxis operating across Chinese cities, growing to 1.9 million vehicles by 2035, representing 25% penetration of the entire shared mobility market. This isn't just growth; it's the emergence of an entirely new transportation paradigm.

The structural drivers behind this transformation are equally compelling. A critical labor shortage is developing: approximately 4 million taxi and ride-hailing drivers will retire by 2035 as the aging population exits the workforce.

Multiple Chinese cities, including Shenzhen, Hangzhou, and Chengdu, have already extended maximum driver age limits to 65 to cope with shortages. This demographic shift creates an urgent structural demand that robotaxis are uniquely positioned to fill.

Pony.ai's Q1 results demonstrate the clearest transition from "Young Growth" to "High Growth" phase among China's robotaxi leaders.

Total revenue climbed 11.6% to $14.0M, driven by a remarkable 200% surge in robotaxi services revenue to $1.7M. Even more striking, fare-charging revenue alone skyrocketed approximately 800% year-over-year. These aren't just impressive percentage gains—they represent genuine market validation that consumers are willing to pay for autonomous transportation services at scale.

Yet this growth momentum comes with a significant price tag. Net losses widened dramatically to $37.4M from $20.8M in Q1 2024, reflecting the massive capital requirements inherent in scaling autonomous vehicle operations. Operating expenses, surged 56.3% to $58.4M.

This apparent contradiction—accelerating revenue growth alongside expanding losses—actually signals healthy scaling dynamics, where companies sacrifice short-term profitability to capture long-term market position.

More importantly, Pony.ai's technological breakthroughs directly validate Goldman Sachs' cost reduction projections.

Their Gen 7 Robotaxi system achieved a remarkable 70% reduction in bill-of-materials costs while improving remote assistant ratios from 1:3 to 1:20. This directly addresses the industry's most persistent challenge: making the hardware stack economically viable at scale.

These operational improvements align perfectly with Goldman Sachs' forecast that remote assistant costs will decrease from $2,600 per vehicle annually to $1,200 by 2030 as technology evolves to require less human monitoring.

When combined with 50% lower insurance premiums, these operational improvements create the foundation for eventual profitability.

This technological advancement enables Pony.ai's most consequential strategic shift: the accelerated move from "China First" to global expansion. The timing and speed of this pivot are particularly noteworthy.

The rapid succession of international partnerships reveals a carefully orchestrated global strategy. The Uber partnership for Middle East deployment, ComfortDelGro collaboration, and simultaneous testing permits in Luxembourg and South Korea suggest Pony.ai recognized an urgent strategic window.

This acceleration likely responds to competitive pressure from domestic rivals Baidu and WeRide, who are pursuing similar international expansion strategies. Pony.ai is sending an unmistakable signal: they're not content with domestic market leadership—they're positioning for global autonomous mobility dominance.

Speaking of WeRide their Q1 results show modest revenue growth at 1.8% to $10M, the composition tells a more nuanced story: robotaxi revenue jumped from 11.9% to 22.3% of total revenue, indicating successful business model evolution toward higher-value autonomous mobility services.

WeRide now operates over 1,200 vehicles globally with 500 dedicated robotaxis—meaning approximately 700 units comprise robobuses, robosweepers, and robovans.

This diversification demonstrates impressive execution complexity, but it also introduces questions about focus. Managing such a varied global fleet across 10+ countries is a massive execution challenge.

The company maintains this complexity is actually a strength, with CFO Jennifer Li emphasizing: "Our sensor suite costs have reduced by more than 70% over the past five years... with 90% shared components across different autonomous driving products."

WeRide's crown jewel remains its expanded Uber partnership, committing to 15 additional cities globally over five years backed by an additional $100 million equity investment. This gives WeRide immediate access to existing ride-hailing infrastructure and customer bases across international markets.

But let’s be real: for Uber, this is a hedge, not a marriage.

They’ve invested in other AV companies and maintain partnerships with multiple players across the industry.

WeRide’s Net losses narrowed 17.7% to $53.1M despite R&D expenses increasing 17.3%. This suggests better operational discipline in scaling investments relative to revenue growth.

However, WeRide’s announcement of a $100M share buyback program raises strategic questions.

It feels like a confidence play, but let’s be honest:

It’s a move intended to send the signal: 'We believe in our long-term value.'

But as Aswath Damodaran would argue, buybacks should come after a company has proven its ability to generate excess cash, not when it's still deep in the red.

The operational achievements validate WeRide's technology robustness across extreme conditions. The first driverless robotaxi testing in Abu Dhabi demonstrates capability in extreme heat conditions, while their 24/7 autonomous ride-hailing network covering central Guangzhou's core areas represents some of the most complex urban scenarios globally.

These deployments across 30 cities in 10 countries provide valuable operational learnings, but they also fragment resources and attention compared to more focused approaches. The question becomes whether this diversification creates sustainable competitive advantages or simply spreads the company too thin across multiple challenging markets simultaneously.

Meanwhile, Baidu's Apollo Go quietly established itself as the scale leader, announcing over 1,000 fully driverless vehicles deployed across 15 cities with more than 11 million rides completed since 2019. In Q1 alone, Apollo Go delivered 1.4 million rides—a 75% year-over-year surge.

The company's partnership with CAR Inc. for autonomous vehicle rental services suggests they're expanding beyond ride-hailing into broader mobility solutions.

The competitive dynamics are heating up as the race shifts from technological proof-of-concept to commercial viability. It's now about who can scale fastest and move to profitability first while maintaining the safety and comfort standards which are critical for widespread adoption.

Accident rates remain a crucial swing factor for expanding customer acceptance and reputation risk—traditional taxis cause 0.036 fatal accidents per billion kilometers traveled, and robotaxis must demonstrably outperform this benchmark to gain public trust and regulatory approval.

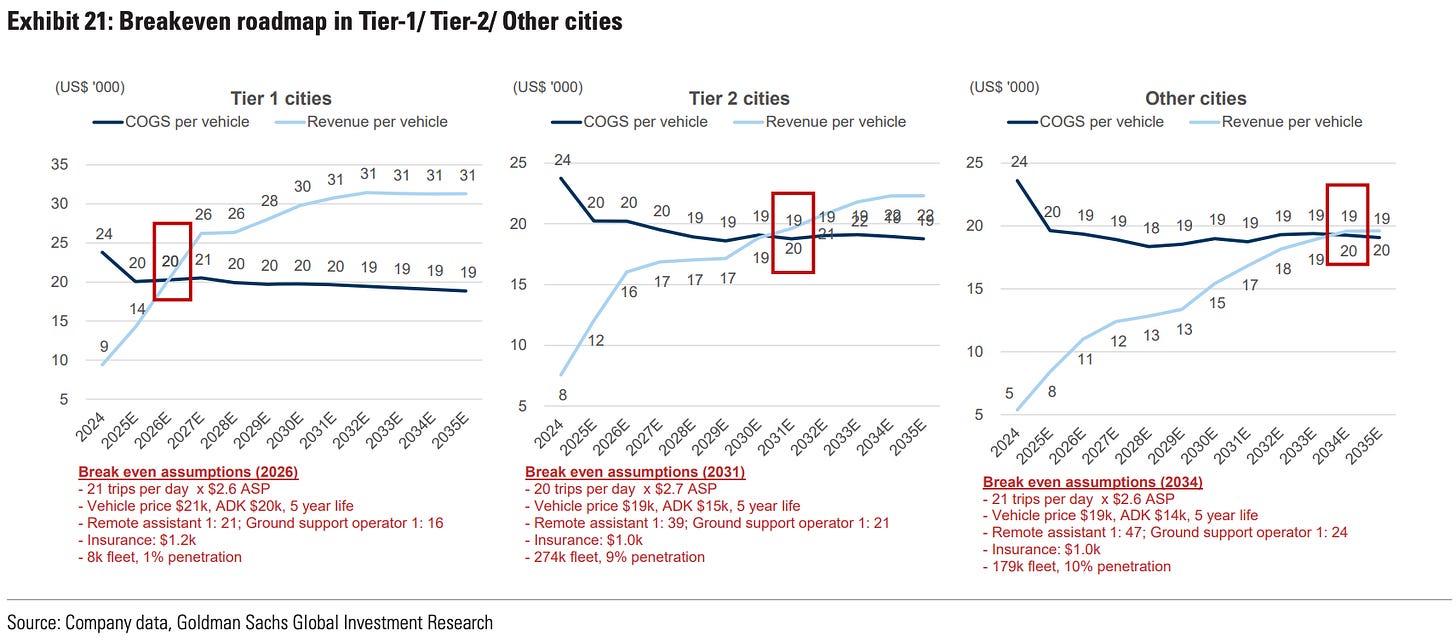

Goldman Sachs projects that Tier-1 cities will reach breakeven by 2026, driven by decreasing hardware costs and improving operational efficiency. Their analysis shows robotaxi revenues per vehicle reaching $31,000 annually in Tier-1 cities by 2035—significantly higher than traditional ride-hailing due to longer operating hours and efficient route planning.

The path to profitability follows a clear timeline: positive gross margins at the vehicle level by 2026 in Tier-1 cities, 2031 in Tier-2 cities, and 2034 in other markets.

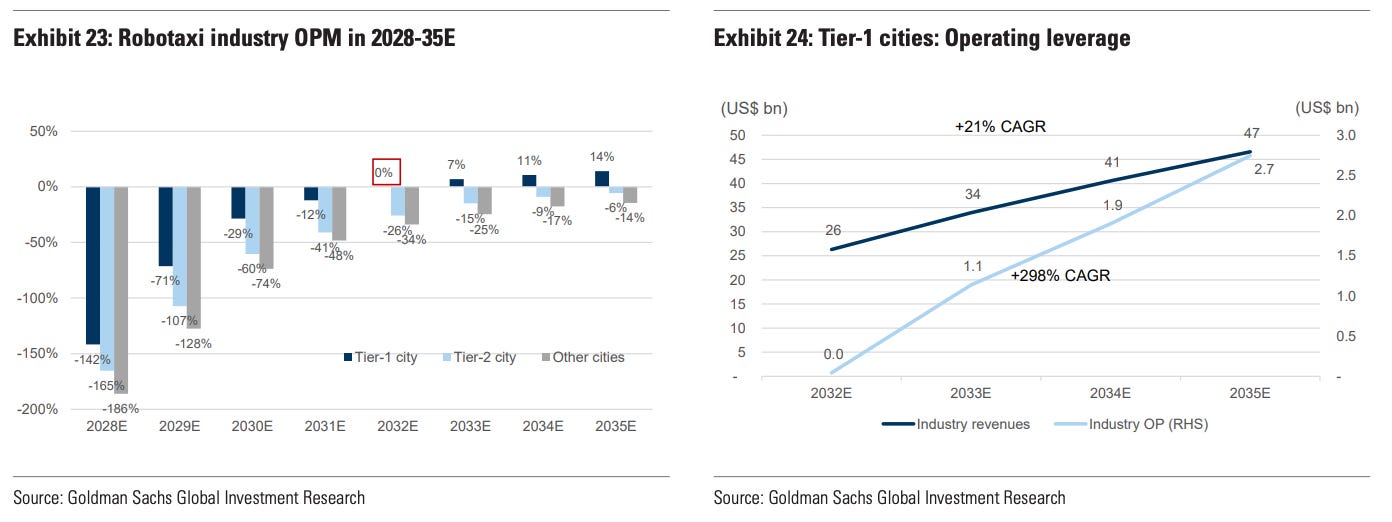

The path to profitability reveals a more complex timeline than the headline "breakeven by 2026" suggests. Goldman Sachs expects China's robotaxi industry to achieve unit-level gross margin breakeven by 2026 in Tier-1 cities, but operating-level profitability won't arrive until 2032.

This six-year gap reflects the massive fixed costs that must be absorbed as the industry scales. At the operating breakeven point, Goldman Sachs projects R&D expenses will need to decrease to $7,800 per vehicle annually, with SG&A expenses falling to $4,100 per vehicle—a dramatic reduction from current levels where companies like WeRide spend 70.3% of operating expenses on R&D alone.

This acceleration stems from robotaxis' cost structure: only 23-42% of COGS are variable, meaning the relatively low variable costs support dramatic profitability improvements as fleet size increases. The increasing fleet size will quickly dilute the burden of R&D and SG&A spending, creating the operating leverage that transforms this from a capital-intensive business to a highly profitable one.

However, Goldman Sachs identifies critical risks that could derail this trajectory. Competition represents the primary threat to long-term profitability, with tech giants, traditional OEMs, and ride-hailing platforms showing increasing interest in entering the market.

Their sensitivity analysis reveals how fragile the profit assumptions are: if average selling price per ride falls from $3.00 to $2.50 due to competitive pressure, industry operating margins in Tier-1 cities would collapse from +14% to -3%. Similarly, if daily orders per vehicle drop from 29 to 24 due to market saturation or competition, operating margins would fall to -4%.

Safety risks pose an equally existential threat. A single fatal accident could devastate industry adoption by causing loss of public trust. Unlike traditional automotive recalls that affect specific models, a robotaxi accident could delay adoption of the entire technology category. This makes the current phase particularly precarious—companies are investing billions in scaling fleets before safety records are fully established across all operating conditions.

The scaling challenge extends beyond technology to operational complexity. As fleets expand, maintenance becomes exponentially more challenging. Robotaxis require not just traditional vehicle maintenance but specialized sensor calibration, software updates, and real-time remote monitoring.

Cleanliness becomes a critical adoption factor, requiring in-vehicle cameras, automated cleaning systems, and potentially outsourced maintenance partnerships like Waymo's arrangement with Avis. The operational overhead of managing thousands of driverless vehicles presents challenges that pure software companies have never faced.

However, Goldman Sachs' market projections suggest this massive market can support multiple winners. It will be interesting to watch how this all plays out.

Bottom line: China's robotaxi earnings season revealed an industry transitioning from technological development to commercial scaling. As Goldman Sachs notes, the question is no longer if L4 autonomous technology is ready, but how companies will commercialize the rapid pace of development. Key factors to watch include decreasing hardware costs, unit economics turning profitable, and accident rates as crucial swing factors for customer acceptance. With 500,000 robotaxis expected across 10+ Chinese cities by 2030 and clear paths to profitability, the foundation for one of the largest transportation transformations in history is being laid now.

🔗 Pony.ai / WeRide / Bloomberg (1) / Bloomberg (2) / Seeking Alpha (1) / Seeking Alpha (2) / Goldman Sachs / Gasgoo / SCMP / CNEVPOST / Yicai Global

💡 Quick Takes:

🇩🇪Germany Pioneers Rural Autonomous Transit Testing

Mecklenburg-Vorpommern launches Germany's first autonomous on-demand bus pilot, targeting rural mobility challenges by 2028. The Berlin-based Motor AI-equipped minibus will operate in Hagenow initially, with gradual passenger introduction planned for 2027. This represents a critical test case for autonomous vehicles addressing underserved markets where traditional public transit economics fail. Rural deployments could prove more viable than urban robotaxis due to simpler operational environments and clearer value propositions.

🔗 Taxi Heute

📱 Oxa Scales Industrial Automation Through EV Partnership

Google-backed Oxa expands autonomous software deployment via partnership with Bradshaw EV, targeting industrial applications including the T800 tow tractor and Club Car Carryall 500. Industrial autonomous applications often present clearer ROI calculations and controlled environments, potentially offering faster paths to profitability than consumer robotaxis.

🔗 UK Tech News

🚘 Waymo Expands California Service Area Authorization

California Public Utilities Commission approves Waymo's commercial service area expansion south of San Francisco, though deployment timeline remains unchanged. The measured expansion approach reflects both regulatory caution and operational discipline—critical factors as the industry matures beyond initial market trials.

🔗 TechCrunch

🏁 Amazon's Zoox Enters Atlanta Race

Zoox announced Atlanta testing just one day after Waymo/Uber revealed their own Atlanta launch—the robotaxi competition is heating up fast. After completing initial mapping with modified Toyota Highlanders, Zoox will begin autonomous testing this summer in their seventh U.S. city.

🔗 TechCrunch

🚘 Tesla's Austin Reality Check

Tesla's first robotaxi test in Austin next month will be heavily geofenced—a major strategy reversal for Musk, who spent years claiming general-purpose autonomy. The company will start with just 10 Model Y vehicles in "safest" areas only, with remote human monitoring and careful intersection avoidance. This "extremely paranoid" approach mirrors what Waymo has been doing for years, suggesting Tesla is finally acknowledging the complexity gap between FSD demos and commercial robotaxi operations. The shift from "it works everywhere" to "localized parameter sets" reveals how far Tesla still has to go to catch up with competitors already operating thousands of vehicles commercially.

🔗 TechCrunch

📚 Worth Reading

Waymo Stats 2025: Funding, Growth, Fleet Size & More

🔗 The Driverless Digest

AVIA: State of AV 2025

🔗 Autonomous Vehicle Industry Association

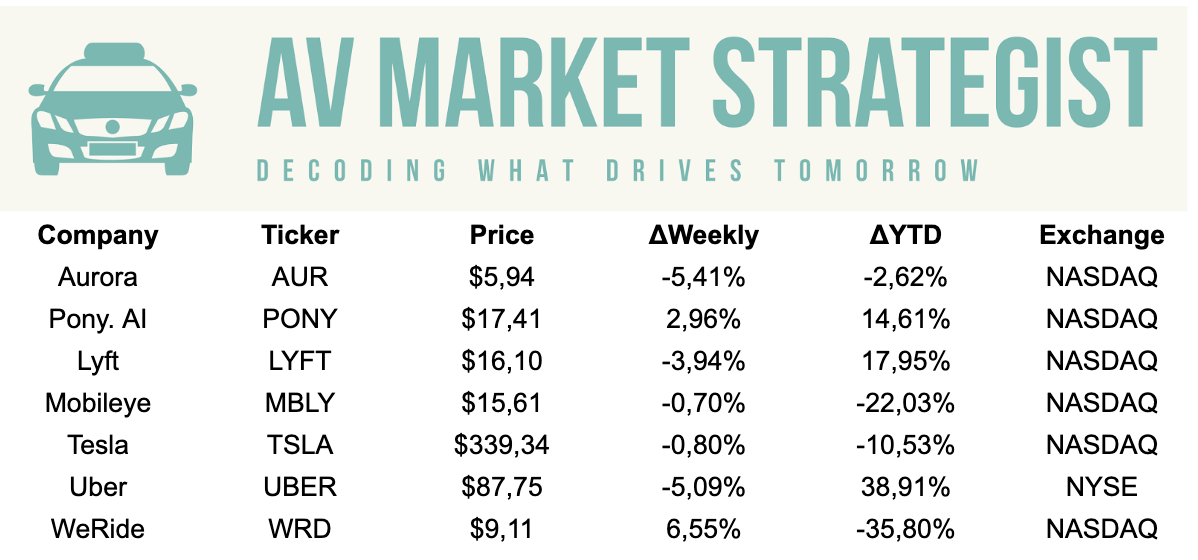

📊 Weekly Performance

Note: Stock performance data as of May 25, 2025. Past performance does not indicate future returns.Thanks for reading!

If you found value in this newsletter, please consider sharing it with a friend or colleague who might benefit from these insights.

And if you haven't already, subscribe to stay updated on the latest developments in the autonomous driving industry.